How Should I Begin Investing?

How To Learn To Be An Investor?

Best Financial Newsletters For Beginners & Expert Investment Newsletters In One

Our monthly investment insights and stock picks newsletter makes investing accessible for everyone, from investments for beginners UK to seasoned money managers. It includes a straightforward beginners guide to investing, using clear language to help on how to predict market trends and the overall financial landscape.

Our paid subscribers also get stock buy and sell alerts, carefully selected for a closer review, ensuring you’re well-informed about potential investment opportunities.

What Is The Best Stock Market News?

Best Newsletter For Market Trends & Stock Market Analysis

Stay on top of market trends and get the best stock market analysis with our expert financial newsletter. Designed for investors of all levels, we provide real-time updates on market movements, in-depth stock analysis, and the latest economic insights. Whether you’re tracking key market trends or looking for actionable stock picks, our newsletter delivers everything you need to make informed investment decisions. Subscribe today to stay ahead in the ever-changing world of investing with the best newsletter for market trends and stock market analysis.

A Stock Market Newsletter That Stands Out

Unlock the world of trading and investing with ease. Our approach simplifies investment opportunities for beginners and provides robust strategies for seasoned investors.

A key strategy we advocate is portfolio diversification. This method not only spreads risk across various asset classes but also aims to enhance your potential for long-term financial stability and growth.

Investment Strategies For 2024

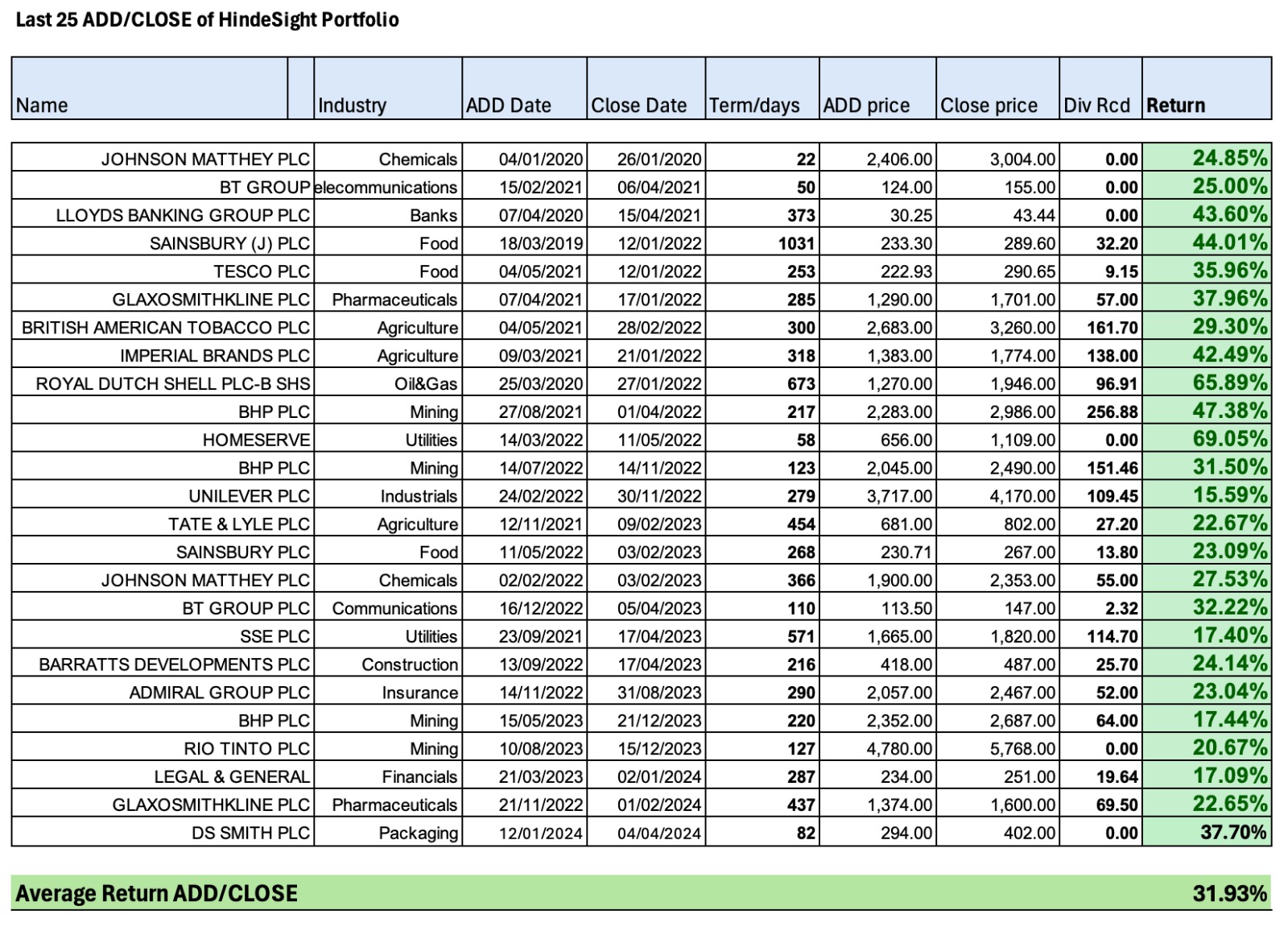

25 Consecutive Top Winning Stocks:

Discover The Power Of Consistent Success With HindeSight Investment Letters.

Our expertly curated investment alerts have secured 25 consecutive gains, offering you proven strategies for 2024 and beyond.

Whether you’re a long-term investor seeking to build a profitable portfolio or you’re looking for reliable stock picks, our service provides unmatched insights into the stock market.

Maximise your returns and enhance your investment knowledge with our timed stock add and close alerts.

Don’t miss out on the opportunity to leverage our winning streak for your financial growth. Join us now and start transforming your investment approach with our top investment tips.

While we’ve achieved 25 consecutive successful alerts, it’s important to remember that the value of investments can fluctuate, and past performance is not indicative of future results. All investors should conduct their own research and consider their financial circumstances and risk tolerance before investing.

HINDESIGHT WRITERS FEATURED ON:

ONLY £4.99 Per Month – Click Below To Visit Our Substack Page

DIVIDEND STOCK NEWSLETTER

Enhance Your Portfolio With HindeSight’s UK Dividend Letter, Your

Dividend Investing Guide

Investing in dividends can significantly alter your financial landscape, emphasising the importance of supporting companies that reward their shareholders generously.

Yet, savvy dividend investing involves more than just seeking out the highest yields, which might mask deeper financial problems within those high-yielding companies.

At HindeSight, we adopt a strategic approach to dividend investing. Our process includes rigorous analysis of company balance sheets to verify financial health before any investment consideration. We also apply a broader, insightful view of the market dynamics.

Our UK Dividend Letter encapsulates this detailed stock selection strategy alongside our market insights. We diligently work to uncover the most advantageous investments for our subscribers.

Join HindeSight and leverage our expertise. Let our seasoned professionals lead you to the most promising dividend stocks in the UK, where every investment recommendation is well-vetted and strategically sound.

Don’t settle for subpar results. Let HindeSight help you navigate the complex world of dividend investing with confidence. Subscribe now and unlock a brighter future for your portfolio!

BE PART OF THE HINDESIGHT INVESTMENT COMMUNITY

Our goal is to make investment knowledge accessible to everyone and to share the insights typically reserved for seasoned trading floor investors. By educating our readers, we empower them to make well-informed decisions and establish a solid foundation for future financial success.

Every month, we highlight a particular stock that has caught our attention, explaining why it might be valuable for your portfolio too. We also provide a broad market overview, discuss various investment strategies, and explain their significance.

In addition, our newsletter includes ‘add and close’ alerts that complement our insights, offering a comprehensive view of how we manage and implement Portfolio #1. This gives you a complete perspective on the construction and execution of an effective investment strategy.

HindeSight Investment Letters Beginners Guide

Start Your Investment Journey: Our beginner’s investment guide is designed to demystify the world of investing, offering easy-to-understand explanations and practical tips.

No Financial Jargon: We break down complex investment concepts into simple, everyday language, ensuring that even those with no prior financial knowledge can easily grasp the basics.

Step-by-Step Guides: Learn how to start investing with our step-by-step guides, guiding you through every stage of the investment process.

Expert Insights: Gain insights from industry professionals who share their knowledge and experience, giving you a solid foundation to make informed decisions.